Equity Linked Notes (ELNs)

Structured Notes linked to shares, tailor-made to your risk profile and market views.

Equity Linked Notes (ELNs)

Equity Linked Notes (ELNs)

At a Glance

Ability to express a particular view on market price movements

Different types of payoffs available

Potential to earn an enhanced return if the performance of the underlying financial instrument is in line with the expected view

What are ELNs?

ELNs are a type of structured note. They are often used by investors to improve returns on cash holdings when they have a stable or mildly bullish view of stocks.

Who are ELNs Suitable For?

ELNs are suitable for investors who are looking for a higher return on their savings or current account deposits. But instead of owning stocks outright, they can invest in ELNs.

If they have a strongly bullish view of the market, they may prefer to buy the stocks directly at the prevailing market price.

But if prices fell, they could be “put” the underlying stock at a price higher than the prevailing market price at maturity.

ELNs are sophisticated investment products that carry significant risks and are not suitable for investors who do not comprehend the product or are risk averse.

How do ELNs Work?

In discussion with their bankers or stock brokers, investors choose the stocks and ELN yields that suit them. They then invest the principal amount at a discount, which represents the yield on the ELN.

ELNs have a “strike” price, which is at a discount to the “spot” market price, and is expressed as a percentage of the “spot”.

For example, a 95% strike means that the ELN issuer will deliver the stock to the investor when the price falls below 95% of the initial market price on maturity of the note. In other words, on maturity, the investor is delivered the stock at 95% of the initial price.

If the stock price closes at or above the “strike” level at maturity of the note, the investor gets his principal in full. The difference between the principal amount paid to the investor and the initial amount paid by the investor (that is, principal minus the discount) represents the yield on the investment.

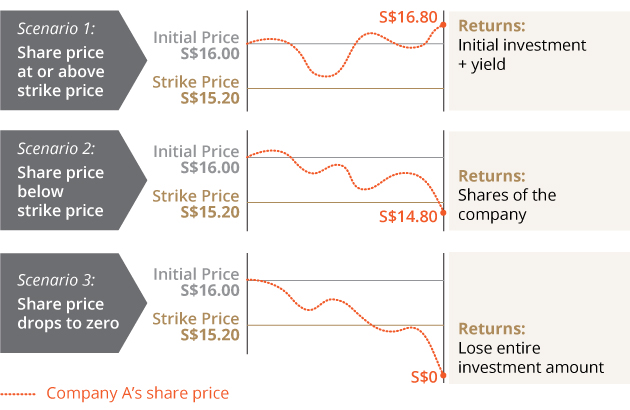

Illustrative example of an ELN with one underlying share:

| Underlying | Company A |

| Initial price | S$16.00 |

| Strike price | S$15.20 |

| Strike level | 95% |

Scenario summary

| Scenario | Company A Performance | At or Above Strike Level | Redemption |

|---|---|---|---|

| 1 | 105% | Yes | Initial investment + Yield |

| 2 | 92.5% | No | Company A shares |

| 3 | 0% | No | Company A shares Total loss of investment |

Benefits of ELNs

| Investors can potentially earn enhanced returns if their selection of stocks, views on market direction and choice of structured payoff are accurate. In general terms, the yield depends on the level of risk assumed by the investor. Yields are generally lower for less aggressive strike levels and for stocks with lower implied volatilities. |

| Investors may be able to purchase shares at their target levels, below the current market prices, while earning an enhanced yield during the tenor of the ELN. |

Risks of ELNs

| Changes in factors such as price of the underlying shares, interest rates, time to maturity of the ELN, implied volatility of the shares, and implied correlations of the underlying shares. These can be unpredictable, sudden and large. Such changes may result in the price or value of the ELNs moving adversely against an investor. |

| ELNs are issued by financial institutions and investors are exposed to the credit risk of the issuer. |

| Investors may lose their entire capital if the underlying share price drops to zero. |

To understand the product-related terms, visit our Glossary.

How to Apply