5 reasons why unit trusts are like buffets

Join the investment game by trying a bit of everything. Units trusts (also known as funds) are a great option to consider if you’re like that hungry foodie who needs a taste of every dish.

When it comes to investing, diversification is always a good way to balance risk and reward in your portfolio. Unit trusts are exactly that, offering a varied selection of investments so you don’t need to pick them individually.

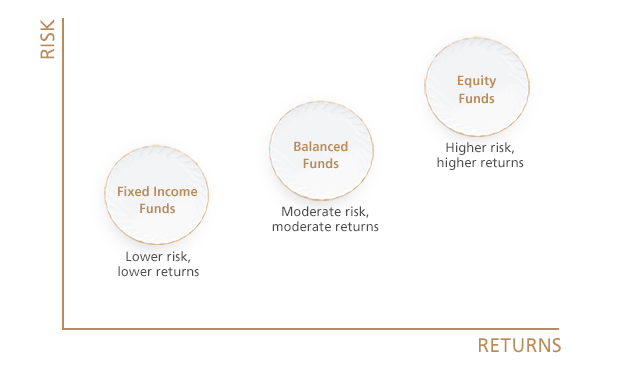

Unit trusts let you invest across a wide range of markets, industries and sectors. They also come with varying risks and rewards so you can always find something to suit your appetite:

Fixed Income Funds: Funds that invest in bonds and payout a fixed amount on a fixed schedule

Equity Funds: Mutual funds that invest primarily in stocks

Balanced Funds: A mix of bonds, equities and commodities

Understanding your risk profile

A fund manager takes care of your unit trust investments – watching the market, selecting investments and adjusting the mix continuously. With access to investment information and research, he can decide on the fund’s strategy and make sharp long-term decisions to manage the funds.

Buffets offer a huge variety at a price significantly lower than if you had ordered all the items à la carte. Similarly, unit trusts enable you to invest in a suite of assets that can include blue-chip stocks at an affordable price, starting from as little as S$1,000.

It’s entirely up to you. Most unit trusts are not locked in for a definite period, and can be sold and converted into cash at any time. So, invest as much as you are comfortable with, using a timeframe that suits you.

- Give yourself a head start

Jump the queue and get into it with a lump sum from your bonus, inheritance or savings. - Grow it steadily

Keep the momentum you’ve got going, by adding to the pot with regular monthly contributions.

How to Apply